Medicaid Fundamentals Explained

Wiki Article

Some Known Factual Statements About Medicaid

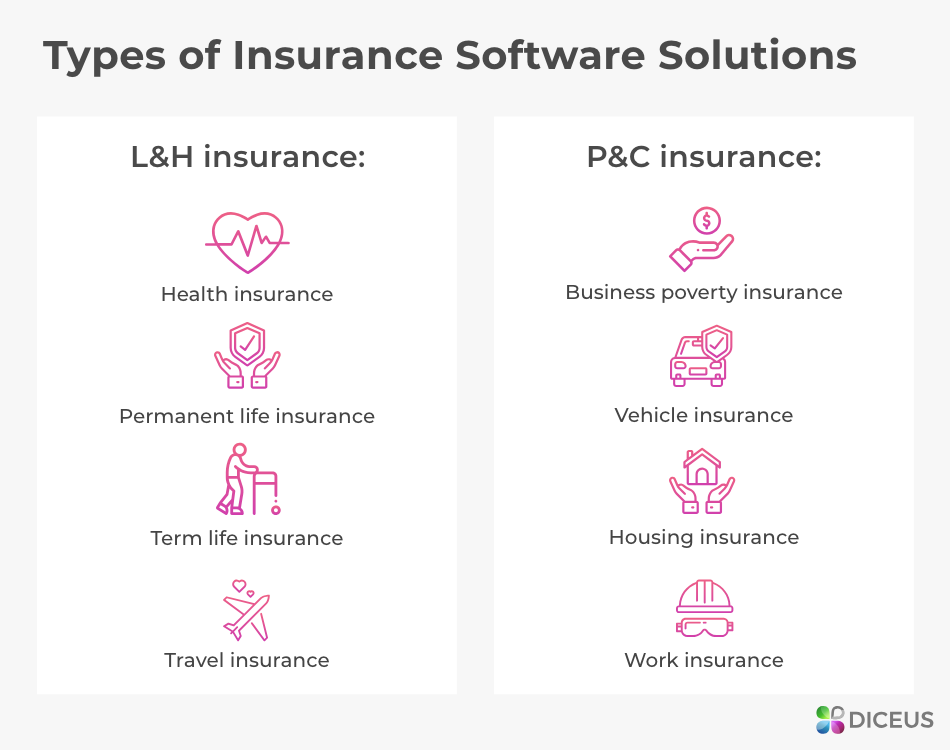

Table of ContentsThe Single Strategy To Use For Car Insurance QuotesThe Facts About Travel Insurance RevealedAll about Health InsuranceSome Known Details About Car Insurance Indicators on Home Insurance You Should Know

If your employer doesn't offer the kind of insurance you desire, acquire quotes from several insurance coverage companies. While insurance coverage is pricey, not having it could be much a lot more pricey.It seems like a pain when you don't need it, yet when you do need it, you're freakin' thankful to have it there (insurance). It's everything about moving the risk here. Without insurance coverage, you can be one car wreckage, health issues or emergency situation far from having a big cash mess on your hands.

Not exactly sure what the difference is in between all of these? Have no fearwe'll break down everything you require to know regarding each of these kinds of insurance policy. 1. Term Life Insurance Policy If there's just one type of insurance coverage that you register for after reading this, make it term life insurance policy.

The Buzz on Home Insurance

No damage, no foul. Yet think about this: The more youthful you are, the extra economical term life insurance policy is. As well as you're never ever mosting likely to be younger than you are today. All that to say, if it's something you think you could make use of in the future, it's less expensive to get it now than in 15 years.Car Insurance policy You need to never drive about uninsurednot even if it protests the legislation however likewise because getting in a fender bender can be ex-pen-sive. The Insurance Info Institute claims the ordinary loss per claim on autos is around $1,057. Envision having to pay that type of cash out of pocket! The great information is, you have actually obtained alternatives when it comes to automobile insurance policy, so there's no factor to miss it.

As well as flood insurance is likewise different than water back-up defense. A representative can assist you make feeling of it all. If you don't live anywhere near a body of water, this insurance coverage isn't for you.

The Facts About Home Insurance Revealed

Keep in mind, if you do not the original source have wind insurance policy protection or a different hurricane insurance deductible, your house owners insurance policy will not cover hurricane damage. If you live in an area where quakes are recognized to drink points up, you might want to tack it on to your policy.Without tenants insurance policy, it's up to you to replace your personal belongings if they're lost in a fire, flood, break-in or a few other disaster. Plus, a whole lot of landlords as well as apartments will require you to have tenants insurance coverage also. A good independent insurance representative can stroll you via the steps of covering the fundamentals of both homeowners and also tenants insurance.

To assist cut back on the cost of wellness insurance, you might get a high-deductible health insurance plan.

You can spend the funds you contribute to your HSA, as well as they grow tax-free for you to make use of currently or in the why not find out more future. You can use the cash tax-free on qualified clinical expenses like medical insurance deductibles, vision and oral. Some companies now supply high-deductible health insurance with HSA accounts as well as typical health and wellness insurance coverage strategies.

The 4-Minute Rule for Car Insurance

Insurance coverage provides assurance versus the unforeseen. You can discover a policy to cover nearly anything, but some are more important than others. Everything depends on your requirements. As you map out your future, these 4 sorts of insurance need to be firmly on your radar. 1. Automobile Insurance coverage Car insurance is important if you drive.Some states additionally require you to bring injury protection (PIP) and/or without insurance motorist insurance coverage. These protections pay for clinical expenditures associated with browse around this site the occurrence for you and also your guests, regardless of that is at mistake. This likewise helps cover hit-and-run accidents as well as crashes with motorists who don't have insurance policy.

This might come at a higher expense and with much less coverage. That's due to the fact that it guards you versus expenditures for building damage.

In the event of a robbery, fire, or disaster, your renter's plan should cover many of the expenses. It may additionally aid you pay if you have to stay in other places while your house is being repaired. Plus, like house insurance policy, renters supplies liability security.

The Buzz on Medicaid

That way, you can keep your health and health to satisfy life's demands.Report this wiki page